Property Tax Overview

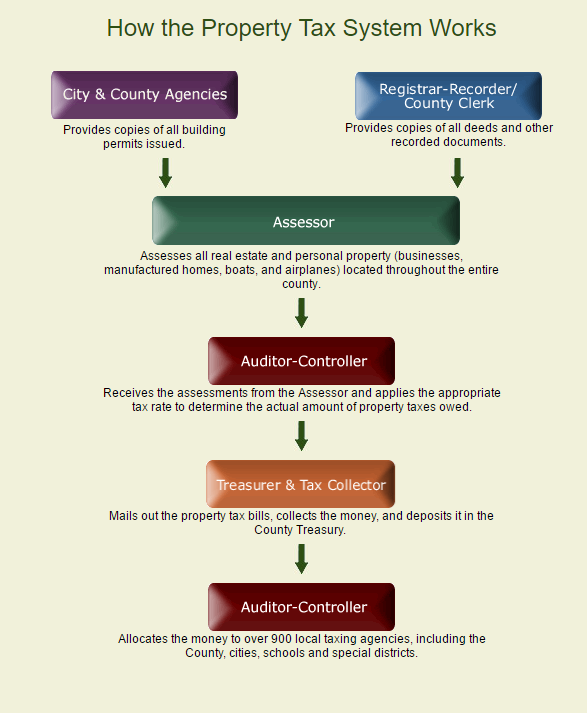

It takes three separate Los Angeles County offices, Assessor, Auditor-Controller, and Treasurer and Tax Collector to produce and account for your property tax bill and payment

.

Assessor

The Los Angeles County Assessor establishes the assessed value of your property by appraising the value of that property under applicable State laws. The assessed value is then placed on a list with all other properties in Los Angeles County and this list is called the “Assessment Roll.” The Assessor also approves and applies all exemptions, which are added to the Assessment Roll. The Assessment Roll is then presented to the Los Angeles County Auditor-Controller for further processing.

Auditor-Controller

The Los Angeles County Auditor-Controller adds direct assessments to the Assessment Roll then applies the tax rates, which consists of general (1%) levy and debt service (voter & bonded) tax rates to the value to create an Extended Assessment Roll. The Extended Roll is then sent to the Los Angeles County Treasurer and Tax Collector for individual tax bill distribution and payment collection.

Treasurer and Tax Collector

The Los Angeles County Treasurer and Tax Collector receives the Extended Roll, prints and mails the property tax bills to the name and address on the Extended Roll. The Treasurer and Tax Collector collects secured and unsecured taxes. Secured taxes are taxes on real property, such as vacant land, structures on land, i.e. business/office building, home, apartments, etc. Unsecured taxes are taxes on assessments such as office furniture, equipment, airplanes and boats, as well as property taxes that are not liens against the real property.

Areas of Responsibility

The following list of Areas of Responsibility may help you to determine which department can assist in answering your inquiry.

|

Supplemental Taxes

In addition to annual taxes, you may be responsible for paying supplemental property taxes. Supplemental bills are based on the difference between the old assessed value and your new assessed value, which is generally your purchase price. This amount is prorated based on the number of months left in the fiscal year from the date you purchased your home. If the property is reassessed at a lower value, you will receive a refund.

Supplemental tax bills are your responsibility and will be mailed directly to you by the Treasurer and Tax Collector’s Office approximately 6 months after your purchase. These bills are not generally paid by impound accounts. You may view your estimated supplemental tax amount by clicking here:

The Supplemental Tax Estimator provides an estimate of the amount of supplemental taxes you can expect to pay if you have recently purchased a property. Please note that the estimator is intended for changes in ownership only and not for new construction.

There are a number of situations in which the Supplemental Tax Estimator will not be able to produce a reliable estimate. The most common are:

- More than one change in ownership has occurred in a calendar year.

- A change in ownership and new construction has occurred in a calendar year.

- Partial interest transfers where less than 100% of the property has changed ownership.

- Some new housing tracts or condominium subdivisions in which the map recording and change in ownership has occurred in the same calendar year.

If you would like an estimate of the supplemental taxes in these or other atypical situations or have additional questions about supplemental taxes, you may email the Assessor’s Office at helpdesk@assessor.lacounty.gov